|

|

|

|

Ideal Savings Plan

Earning special interest return while making savings plan

Product Features

Product Features

How fast can you make your dream comes true? BCM “Ideal Savings Plan” - the power of motivation for earning special interest return while making savings plan.

Special Interest Return

Open the “Ideal Savings Plan” and you can gain special interest return simply by defining your monthly deposit amount and make relevant monthly deposits in accordance to the pre-defined deposit period, that is, until maturity of the savings plan.

Currencies at your choice

BCM “Ideal Savings Plan” is available at MOP, HKD or RMB to meet your different savings needs as well as to help you catch up the growth trend of your desired currency(ies).

Lowest Monthly Deposit Amount

You can define the “Ideal Savings Plan” monthly deposit amount based on your needs at the minimum of MOP/HKD/RMB500 per month.

Flexible Deposit Period

Ideal Savings Plan provides flexible deposit period of 12, 24 and 36 months for MOP or HKD and of12 or 24 months for RMB to fit your savings objective.

Free and Easy Deposit Transfer

We understand that you may find its inconvenience to make monthly deposit with time limit. The “Ideal Savings Plan” provides you with a free transfer service that the monthly deposit amount will be automatically transferred from your pre-defined MOP/HKD/RMB account to your “Ideal Savings Plan”.

SMS Deposit Alert

In order to avoid any failure of making monthly deposits and subsequently the termination of the savings plan, reminder via SMS will be sent to you before the day of the actual monthly deposit.

Remarks:

- RMB “Ideal Savings Plan” is not available for children’s account.

- If customer fails to make the Monthly Deposit Amount within 7 days, the Bank has the right to terminate the Plan whilst the interest payment will be forfeited.

- Automatic renewal is applicable to “Ideal Savings Plan” upon the maturity of the current deposit cycle, whilst the renewed Special Interest Rate is subject to the Bank’s prevailing rates set forth at the time of the automatic renewal. In case of cancellation of the automatic renewal, customer has to provide written instruction or approach any branch of the Bank at least 7 working days prior to the maturity.

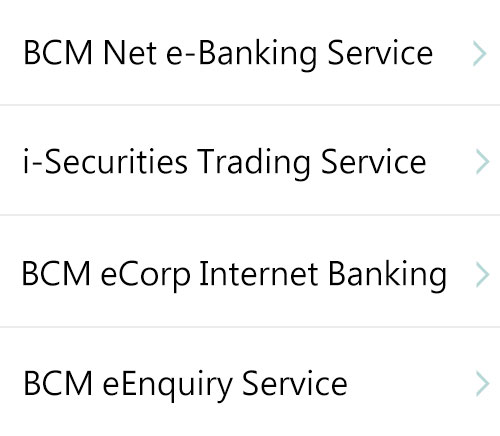

Related services and promotions

About Us Contact Us Job Vacancy Branch/Self-Service Banking Centre Network Site Map Internet Privacy Policy Statement and Disclaimer Supervised Authority Disclaimer: The Products / Services provided by BCM bank are not targeted at the customers in EU. This website is optimized for Internet 11+ / Google Chrome / Safari, and is best view with screen resolution 1024 x 768.。 © Copyright Banco Comercial de Macau,S.A. 2003 - 2019. All rights reserved. |