|

|

|

|

MPay信用卡充值服務

全新體驗 即時充值話咁易

Product Features

Service Introduction

How to register

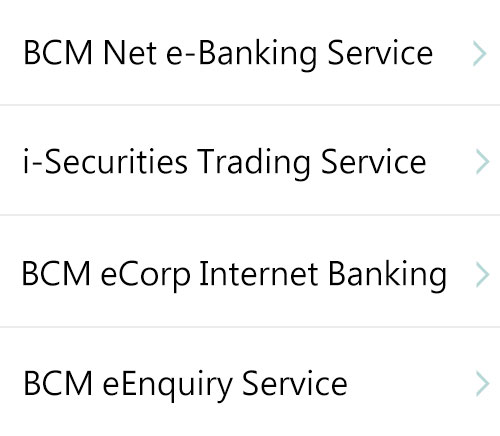

Cooperating e-Partners

BCM bank proudly presents the brand new Digital Payment Service! By registering your designated BCM account with our cooperating e-merchant(s)’s platform, customers can directly debit the registered account to make instant payment through the e-merchant app in their mobile device at both online or offline shops anytime, anywhere and enjoy a one-stop convenient electronic payment service.

- Instant registration without any complicated formalities

- Two-factor Security Authentication approach with high protection

Customers are required to download the relevant e-merchant’s app on their mobile device and then register the designated bank account in the app. Upon successfully provided the requested customer and account information and completed the bank’s two-factor security authentication procedures, customer can then make instant payment by automatic debiting the account at ease.

Friendly Reminder: Customers must ensure that the personal information, mobile phone number, etc. are aligned with the bank account’s record in order to perform the registration successfully.

Terms & Conditions

FAQs

User Guide

| 1. | Banco Comercial de Macau, S.A. (“BCM” or “Bank”) offers its Customers (“Customer”) the registration and the use of BCM Digital Payment Service (“Service”) through the Bank’s collaborated third-party payment service provider(s) (“Service Provider”). | ||||||||||

| 2. | The Customer must be a valid account holder of the Bank’s designated account type (including deposit account and credit card account) (“Designated Account”) in order to be eligible to use the Service. | ||||||||||

| 3. | Digital Payment Service | ||||||||||

|

|||||||||||

| 4. | Digital Payment Service Registration | ||||||||||

|

|||||||||||

5. |

The Customer, upon accepting these Terms and Conditions through the internet, application or other electronic means and the OTP during the registration process for the Service, is deemed to accept all the terms and conditions of the Service and agree to bear all the relevant responsibilities arising thereof. | ||||||||||

| 6. | Digital Payment Transaction | ||||||||||

|

|||||||||||

| 7. | The Customer shall take proper care of all the materials and information related to the Service, including the account name, ID type and ID number, mobile phone number, etc. (“Material and Information”) to avoid any unauthorized use by any unauthorized person or for any unauthorized purpose. In case of a potential Material and Information leakage, the Customer should immediately contact the Bank in order to temporarily suspend or permanently terminate the Service. | ||||||||||

| 8. | The Bank shall not be liable for any loss, damage or expense that may arise or suffer from the use of the Service by the Customer or any other person, or by processing or executing the Customer's instructions or requirements relating to the Service, unless any such loss, damage or expense is directly and reasonably foreseeable and is directly caused by negligence or willful default of the Bank or its officers, employees or agents. | ||||||||||

| 9. | When the Customer authorizes other persons to issue instructions or requests to the Bank regarding the use of the Service (whether the customer is an individual, a company, a corporation, a sole proprietor or in partnership or any other unincorporated organization): | ||||||||||

|

|||||||||||

| 10. | The Customer must not use the Service for cashing out, fraudulent transactions, money laundering, etc., and is obliged to co-operate with the Bank to conduct relevant investigations when deemed necessary. In the situation of refusal of co-operation or any suspicious transactions considered by the Bank of conducting fraudulent transactions, money laundering, cashing out or any other illegal activities, or any violation of these Terms and Conditions, the Bank has the rights to adopt any of the following measures: | ||||||||||

|

|||||||||||

| 11. | The Bank reserves the right to block or suspend any access to the Service in those instances that the Bank, pursuant to objective reasons, deems as appropriate, for the protection of the assets of Customer. | ||||||||||

| 12. | These Terms and Conditions supplement and forms part of the Bank's "Master Terms and Conditions" ("Existing Terms"). The provisions of the Existing Terms will continue to apply to the Service to the extent that they are relevant and not inconsistent with the provisions of these Terms and Conditions. Unless otherwise specified, if the provisions of these Terms and Conditions are inconsistent with the provisions of the Existing Terms with respect to the Service, the provisions of these Terms and Conditions shall prevail to the extent of such inconsistency. | ||||||||||

| 13. | The Service is not targeted at customers in the European Union. | ||||||||||

| 14. | The Terms and Conditions shall be binding on both of the Customer and the Bank, irrespective of whether the Customer is an individual, an association, a company, a corporation, a legal person or a successor. When the Customer shall consist of more than one person the obligations herein shall be joint and several. | ||||||||||

| 15. | These Terms and Conditions and all rights, obligations and liabilities hereunder shall be construed and governed in accordance with the laws of the Macau Special Administrative Region. Any disputes shall be resolved by the court of the Macau Special Administrative Region in accordance with the prevailing laws. Both the Customer and the Bank agree that the court of the Macau Special Administrative Region shall have the exclusive jurisdiction. | ||||||||||

| 16. | In case of any conflict between the English and Chinese versions of these Terms and Conditions, the Chinese version shall prevail. |

| 1) | What type of account can be registered to Digital Payment Service? |

|

|

| 2) | Is there any additional handling fee for using Digital Payment Service? |

|

|

| 3) | What kind of transaction(s) can be carried out after registering Digital Payment Service? |

|

|

| 4) | Is there a transaction limit for Digital Payment Service? |

| Each registered account has bank-defined designated transaction limits for usage at each e-merchant: | |

|

|

| Meanwhile, customers must pay attention to the transaction limit of relevant e-merchant to ensure transactions can be executed. At any circumstances that the transaction limits of the bank and e-merchant vary, the one with lower limit shall prevail. | |

| 5) | Why does it prompt that the personal information does not match when registering the account? |

|

|

| 6) | If customer changes the personal information registered with the bank, will it affect the use of the service? |

| If customers modify the information registered at the Bank, such as name, ID card information, mobile number, etc.: | |

|

|

| 7) | What should I do if there is a problem when using the e-merchant app? |

| If customers encounter any problem when using their services, enquiries can be made through the following methods: | |

Macau Pass

|

|

UePay Macao

|

Related services and promotions

About Us Contact Us Job Vacancy Branch/Self-Service Banking Centre Network Site Map Internet Privacy Policy Statement and Disclaimer Supervised Authority Disclaimer: The Products / Services provided by BCM bank are not targeted at the customers in EU. This website is optimized for Internet 11+ / Google Chrome / Safari, and is best view with screen resolution 1024 x 768.。 © Copyright Banco Comercial de Macau,S.A. 2003 - 2019. All rights reserved. |